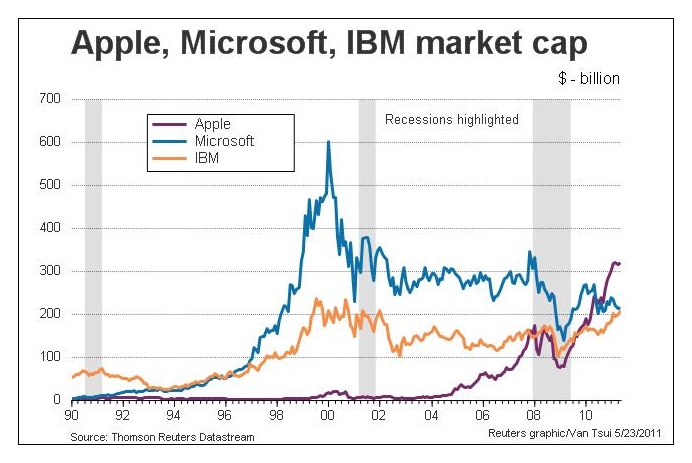

For the first time in 15 years, since 1996, IBM has overtaken Microsoft in market value. It is now the second largest US tech company behind Apple, while Microsoft has dropped to third.

Only a year after Apple had surged past Microsoft in market value, IBM has also powered past Microsoft.

IBM had been the dominant company in the computer industry for decades until it selected Microsoft to supply the operating system for its personal computers in the eary 80s. Bill Gates managed to turn that opportunity into a dominance of the operating systems market.

| Rank | Company | Market cap

(billion) |

|---|---|---|

| 1 | Exxon Mobil | $397.4 |

| 2 | Apple | $309.2 |

| 3 | General Electric | $205.6 |

| 4 | IBM | $203.8 |

| 5 | Microsoft | $203.7 |

At its zenith just before the turn of the millennium, Microsoft’s market capitalisation was three times that of IBM’s. It was also the biggest US company then. Now it is the third biggest technology company and fifth biggest US company.

Microsoft is facing challenges in many of its business sectors. Its dominance of the operating systems market, is being challenged by the advent of tablets and Google’s newly introduced Chrome OS, while it has lost its market share in the smartphone market to RIM’s BlackBerry devices, Apple’s iPhones and recently Android based phones.

Microsoft’s decline since 2000 coincides with the burst of the Internet technology bubble and the tenure of Bill Gates’ successor Steve Ballmer as the CEO.

IBM, on the other hand, has reinvented itself from being a predominantly hardware manufacturer into a specialist in enterprise software, servers and consulting. It has even offloaded its PC business to Lenovo in 2002.

Bill Rigby of Reuters observes that “an investor putting $100,000 into both stocks 10 years ago would now have about $143,000 in IBM stock and about $69,000 in Microsoft stock.”